IRS Extends Filing Deadline. Should You Wait?

- Detalles

- Escrito por Drew Guthrie

- Categoría: Articles

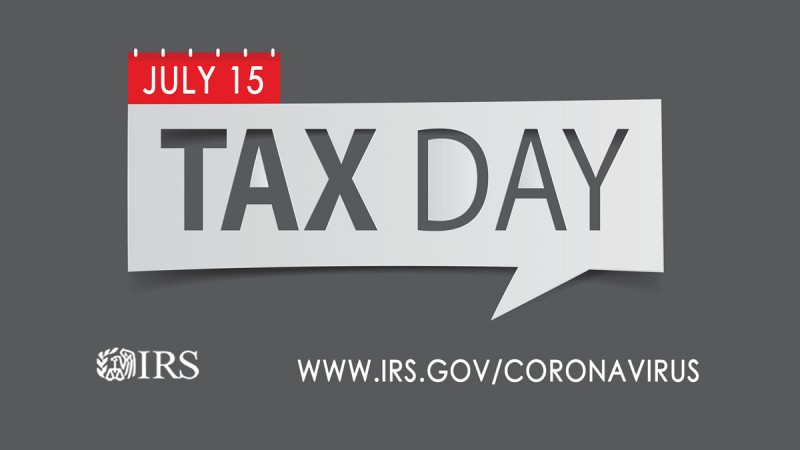

The IRS has extended the federal income tax filing due date to July 15, 2020. This applies to all taxpayers. You don't have to apply for this extension. This extension may not apply to your state income tax. So you will need to check to see if your state has extended the deadline.

This extension may not apply to your state income tax. So you will need to check to see if your state has extended the deadline.

The IRS is encouraging taxpayers who are due a refund to not wait but to go ahead and file their taxes electronically. The IRS is still working and most refunds are being issued within 21 days. Though the IRS has closed all Taxpayer Assistance Centers and discontinued face-to-face service, online services are still available.

If your taxes are straightforward, you may be able to do them yourself using Free File. If you use a tax preparer, check to see how they can work with you, if they are still working. Some tax preparers provide ways to have your taxes prepared without having to see you in person.