Keeping Your Payment Apps (and Money) Safe

- Detalles

- Escrito por Will from Holland

- Categoría: Articles

The way we pay has steadily changed over the years. Carrying cash and using plastic cards are becoming an old concept as we shift towards apps and other contactless payment options.

If you do not remember the ups and downs of contactless payments, here is a refresher.

Payment (Money Transfer) Apps

Let's talk payment (money transfer) apps...

There are many options such as Venmo (by PayPal), Square Cash, Zelle, and Google Pay. Even WhatsApp and (Microsoft's) Skype will let you send and receive money via the app. Have you used any of these yet?

All you need is someone's phone number or email address, and sending or receiving money can be done with a click of a button.

Do you need to get reimbursed after fronting money for dinner with friends? Send a money request to your friends using one of these apps and get paid instantly. Some apps even divide the bill into equal amounts between the people you request money from.

The Caveats

But with that convenience comes a couple of caveats.

Most apps are free, but some require fees for different features they provide. It's important to research any app before downloading it to make sure it does what you need, and that you understand the fees (if any) you may have to pay. Realize that payment apps may defer from money transfer apps and that different charges may apply.

With these apps, use of your (linked) bank account or debit card is generally free, however; linking a credit card may cost money even though it may be safer. If you get scammed (see below), you generally have more legal recourse when using a credit card.

Impulse buying = money trouble

With any money situation, if you combine speed with modern technology, it's easy to make a quick decision and impulse buy, aka, spend more money than you have or should.

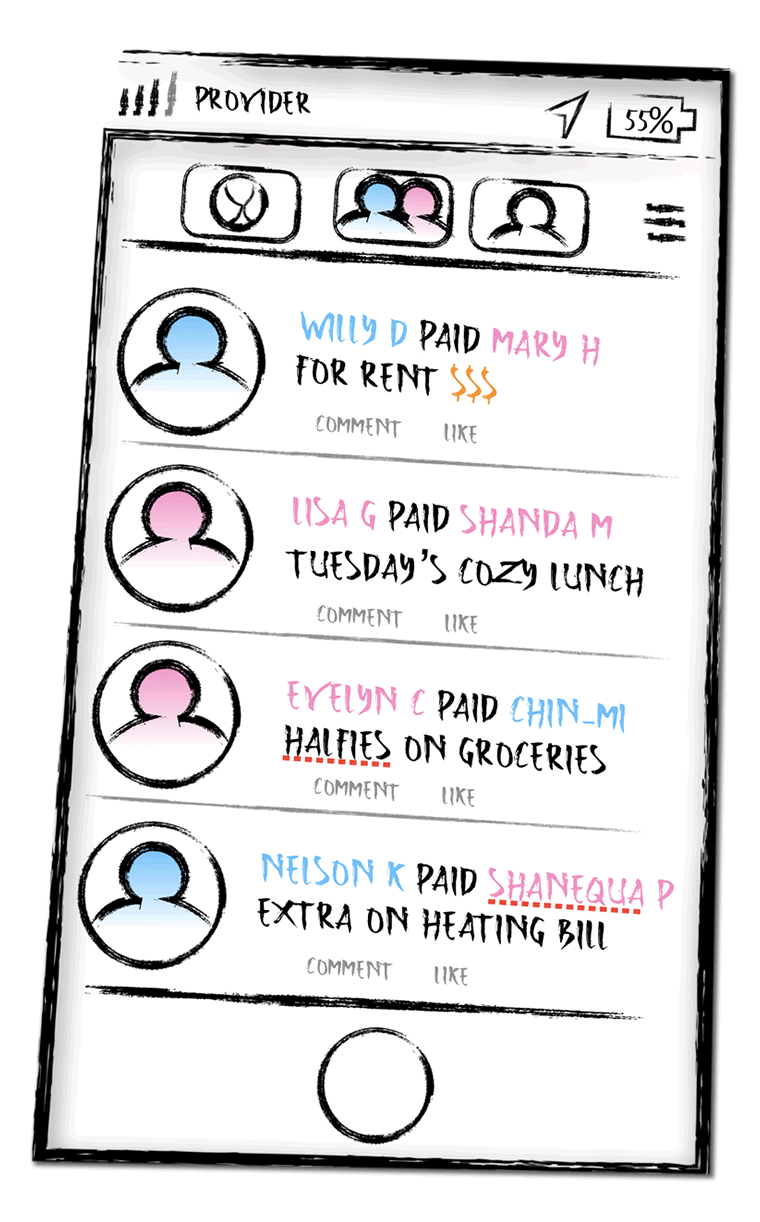

And then there are the social aspect and privacy invasions (read: pay special attention). If you haven't seen the Netflix documentary "The Social Dilemma" on the potential dangers of social media, we highly recommend it!

The film dives into the manipulation techniques it claims that social media companies use to addict their users, and the psychology that is leveraged to achieve this end.

Add your payment apps to this whole social circus, and we're staring trouble right in its face. These apps make it fun (and addictive) to spend money, which could lead to impulsive purchases. Who would have ever thought that social media handles and spending money would go hand in hand...?

Additionally, your app by default is probably set to make transactions and friend lists publicly visible, opening access about your finances to the world.

Consider a couple of questions when using these types of apps: Would it bother you that everyone can see what you ate for dinner, and with whom? Or what items you bought where, or from who? Or how much you spent on something? This is private and sensitive info...

Tips to Keep Your Money Safe

Here are a few tips to keep your money safe:

-

Set Your App Privacy Settings to the Max

Set your transactions to being private, so only your friends can see them. Or better, set them to totally private. No one needs to know about your spending, really. Next, set your friends list to be private, too, if you are able within the app so individuals can't see where you are moving money to and from.Note: Venmo won't let you make your friend list private.

-

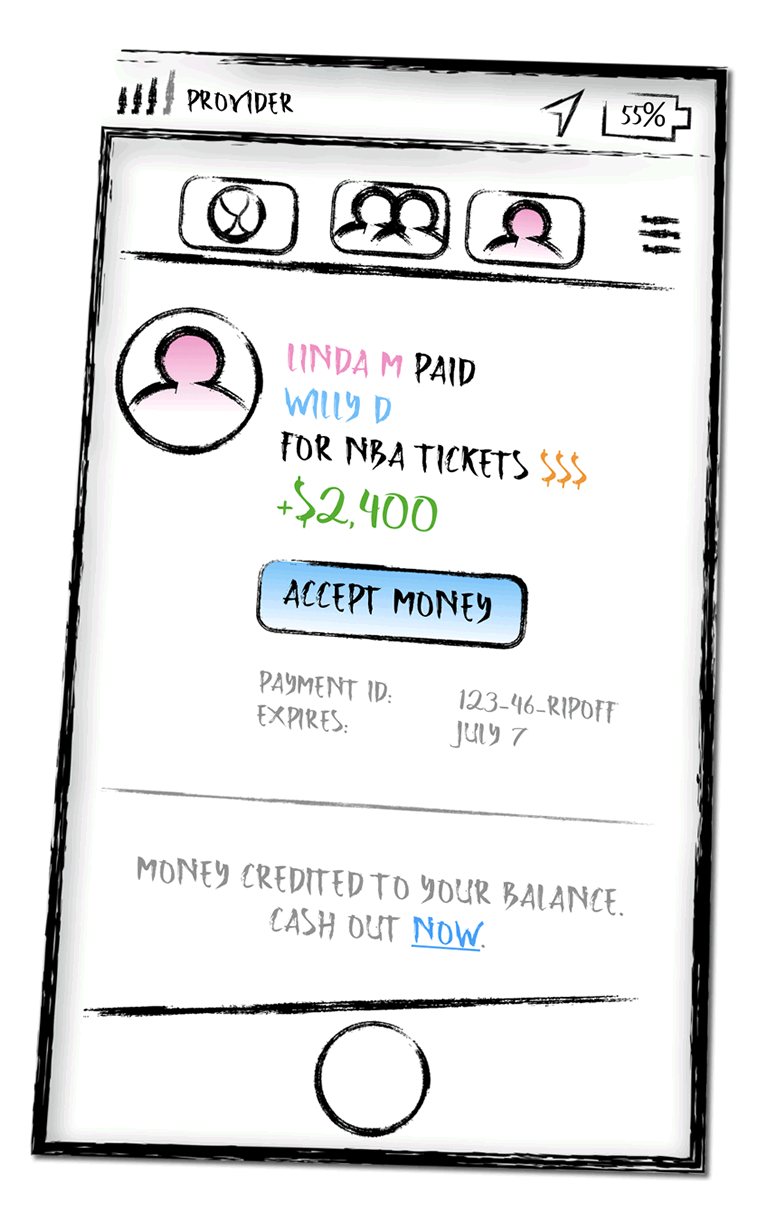

Sell Local, Use Cash

This may be a hassle, but it will help minimize your risk of fraud.When selling things to strangers, it's always a best practice to sell locally, and only deal with cash. If you don't, this may be when the classic "Nigerian scam" comes out to play.

If you must send or receive funds online, read up on online or app payments and the different services available. Many are good and safe, but equally many are not. Check security measures before you even think of using online or app payments with strangers.

-

Login Security

Use multi-factor authentication for your login process or use a secondary passcode or PIN alongside your password. This will help keep your account and money safe. Here's how. -

Set Alerts

Set up user alerts to receive notification if account changes are made, or when transactions happen. You'll be notified instantly, for example, if someone uses your account to pay for things. And you know what? That actually happens through sim swapping or porting... -

Credit Card vs Debit Card

It's safer to pay with a credit card (you can dispute charges with your card provider or bank), but again, this may be more expensive. If you take the above tips at heart, it is probably better to link your checking account or debit card. If you have a tendency to slip with your finances, definitely pay for having the "credit card security." -

Pay from Balance

It may be better to "pay from your online account balance", rather than from your bank account or plastic card. If you leave a (small) balance in your online account, the money you pay can be taken from your balance there, rather than deducted from your personal accounts.Lastly, a note: Please know that transfer limits (both in dollar amount and frequency) may apply for sending or receiving money.

So, there you have the basic rundown on payment apps.

Follow the guidelines above to ensure you are conducting due diligence when using payment apps. I hope this info keeps your apps and money safe.

Cheers, Will